Crypto Giants Ripple and Gemini Team Up for IPO

Crypto exchange Gemini filed for a NASDAQ IPO with the US SEC while securing a $150 million credit line from Ripple.

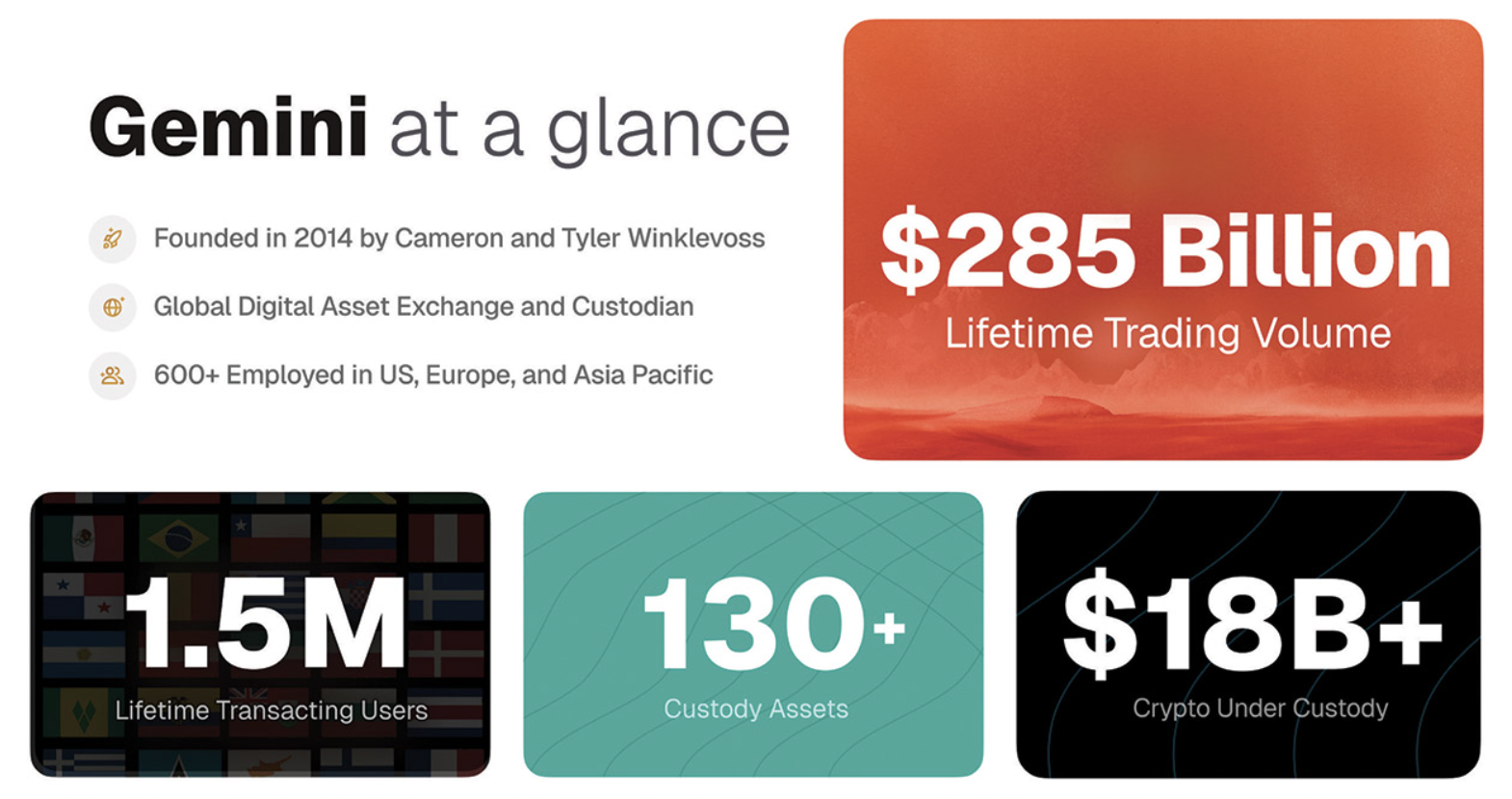

The crypto world just got a major shake-up. Gemini, the crypto exchange founded by the Winklevoss twins in 2014, has filed for an Initial Public Offering on Nasdaq under the symbol “GEMI.” But here’s the twist that caught everyone’s attention: their SEC filing reveals a strategic credit agreement with Ripple signed just last month in July 2025, potentially reshaping how crypto companies fund their growth.

The $75M Credit Line That Changes Everything

This isn’t your typical bank loan. Gemini’s partnership with Ripple creates a flexible credit facility that works more like a corporate credit card than traditional financing. The company can borrow at least $5 million per request, up to $75 million initially – but here’s where it gets interesting: this limit can expand to as much as $150 million under certain conditions.

What makes this deal unique is the currency involved. All lending requests will be made in Ripple’s RUSD stablecoin, which is pegged to the US dollar, but repayments happen in traditional USD. Think of it as borrowing in crypto but paying back in cash. All loans require collateral and carry interest rates between 6.5% and 8.5% annually – competitive rates that suggest Ripple sees Gemini as a low-risk partner.

For Gemini, this credit line solves a critical problem that has plagued many crypto companies: unpredictable cash flow. Crypto markets can swing wildly, and trading volumes can drop suddenly, leaving exchanges scrambling for liquidity. With Ripple’s backing, Gemini can cover short-term cash needs, manage operational expenses, and respond quickly to market opportunities without burning through their cash reserves.

From an IPO perspective, this partnership is pure gold. Investors want to see that companies can weather storms, and having $75-150 million in readily available credit signals that Gemini is built to survive both rapid growth and potential market crashes. It’s the difference between looking like a startup with limited resources and a mature company with institutional backing.

The Numbers Behind Gemini’s Bold IPO Move

Gemini’s financials tell a story that’s both concerning and surprisingly common in the crypto world. For the six months ending June 30, 2025, the company reported a substantial net loss of $282.5 million on revenues of $68.6 million – numbers that would terrify traditional investors but reflect the reality of crypto market volatility.

The year-over-year comparison reveals the challenge: in the first half of 2024, Gemini recorded a much smaller net loss of $41.4 million on higher revenues of $74.3 million. That’s a staggering 580% increase in losses combined with declining revenue – exactly the kind of numbers that make IPO investors nervous.

But here’s the context most people miss: crypto companies often show extreme swings in profitability based on market conditions, regulatory changes, and trading volumes. What looks like financial instability might actually be a reflection of an industry still finding its footing.

The full 2024 picture shows a net loss of $158.5 million against total revenues of $142.2 million – essentially spending more than a dollar for every dollar earned. In traditional finance, this would be a red flag. In crypto, it’s often the price of building infrastructure for the future.

Despite these losses, several factors suggest Gemini might be positioning for long-term success rather than just bleeding money. Their strategic partnership with Ripple, the improving regulatory environment, and the growing institutional adoption of crypto could transform today’s losses into tomorrow’s competitive advantages.

Why Now? The Regulatory Wind Shift That Made This Possible

The timing of Gemini’s IPO isn’t coincidental. In late 2024 and 2025, the U.S. regulatory landscape underwent a dramatic transformation that finally gave crypto companies the clarity they desperately needed. The new presidential administration signaled a more crypto-friendly approach, while the SEC shifted from its previous “regulation by enforcement” strategy to actually providing clear guidelines.

Legislation such as the GENIUS Act didn’t just aim to make crypto legal – it actively encouraged innovation by creating regulatory frameworks that companies could actually follow. For the first time, crypto firms could plan long-term without constantly looking over their shoulders for regulatory surprises.

This positive shift has encouraged many crypto firms to go public. USDC issuer Circle completed a successful IPO in June 2025, with its stock posting large gains. Bullish, a crypto exchange backed by Peter Thiel, went public on August 13, 2025. This trend is paving the way for other major players, like Gemini, to list their shares, bringing new capital and credibility to the crypto industry as it increasingly integrates with traditional financial markets.

Content on BlockPort is provided for informational purposes only and does not constitute financial guidance.

We strive to ensure the accuracy and relevance of the information we share, but we do not guarantee that all content is complete, error-free, or up to date. BlockPort disclaims any liability for losses, mistakes, or actions taken based on the material found on this site.

Always conduct your own research before making financial decisions and consider consulting with a licensed advisor.

For further details, please review our Terms of Use, Privacy Policy, and Disclaimer.