Crypto market down – key drivers behind today’s decline

Crypto prices are sliding on August 22, with Bitcoin, Ethereum, and altcoins under pressure. We break down the key drivers behind today’s market downturn.

Key Points:

- Bitcoin slips below $113K as traders ask why is crypto dumping amid risk-off sentiment.

- Ethereum and major altcoins struggle after renewed U.S. Treasury yield surge.

- Liquidity tightening and reduced trading volumes accelerate the sell-off.

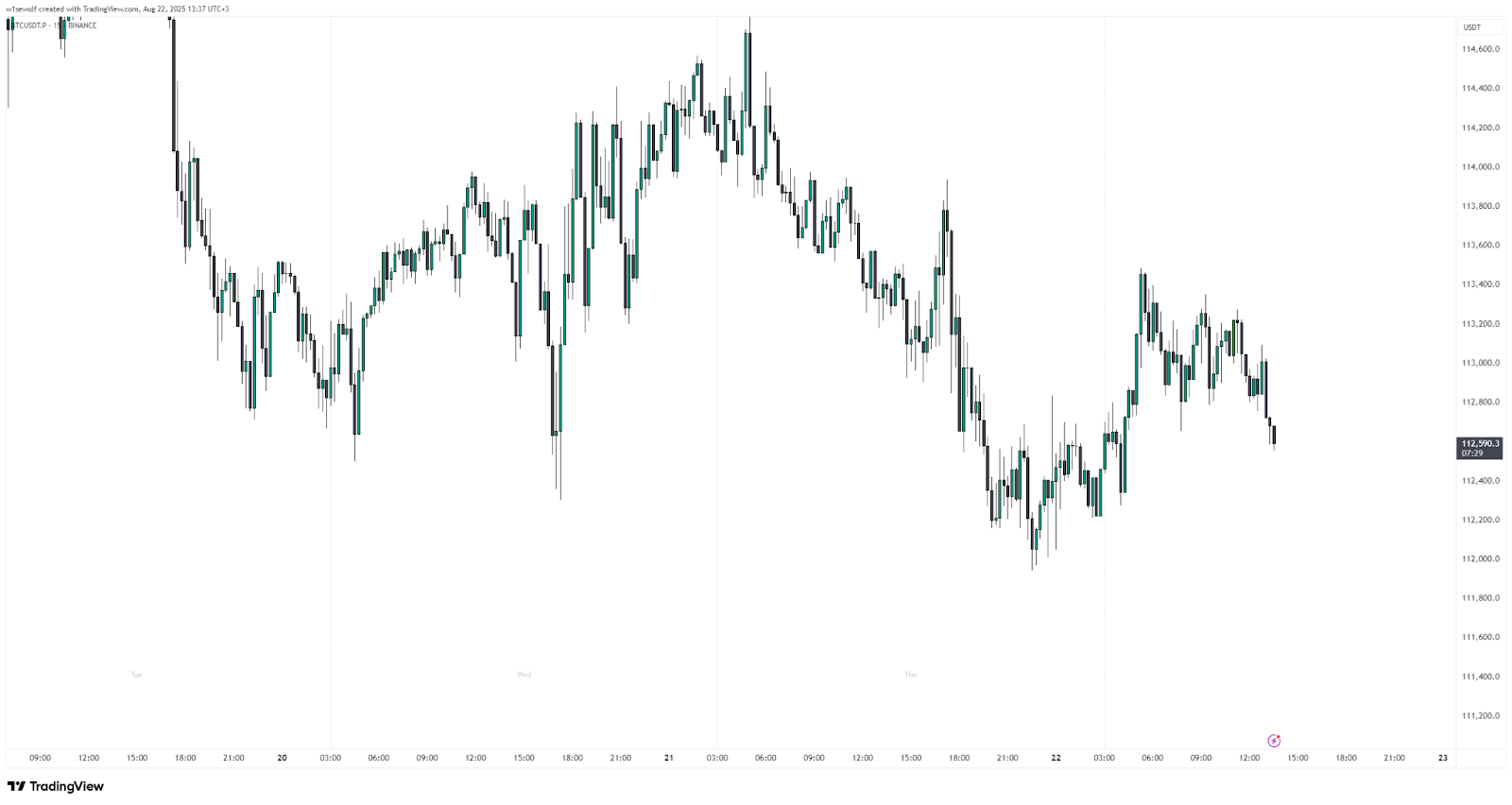

The global cryptocurrency market is trading in the red on August 22. Bitcoin (BTC) dropped to around $112,600, down nearly 0.8% in 24 hours and more than 5% over the week. Ethereum (ETH) is holding slightly above $4,300 but remains nearly 7.5% lower on the week. Altcoins like Cardano (ADA) and Solana (SOL) have seen deeper corrections, with ADA sliding over 11% in seven days. Traders are asking why is crypto market down following sharp declines across major cryptocurrencies.

This analysis examines three critical factors weighing on digital assets today: rising U.S. Treasury yields fueling risk-off flows, concerns about shrinking liquidity in crypto markets, and weak performance across high-beta altcoins. Each of these plays a role in explaining why crypto is going down and why sentiment remains fragile.

Rising U.S. Treasury yields pressure risk assets

A renewed surge in U.S. Treasury yields has pressured risk-sensitive markets this week. The 10-year yield climbed back near 4.3%, signaling stronger expectations for prolonged high interest rates. For traders, higher yields make risk-free assets like bonds more attractive compared to volatile crypto.

This shift partly explains why is crypto crashing today, as institutional capital rotates away from speculative markets. Bitcoin’s correlation with equity indices like the Nasdaq remains elevated, amplifying downside whenever global macro sentiment turns cautious. The latest move reinforces the narrative that tighter U.S. monetary conditions are limiting upside momentum in digital assets.

Weak liquidity and falling volumes

Liquidity across major exchanges has continued to thin, making markets more vulnerable to sharp swings. According to 24-hour volume metrics, Bitcoin trading volume has slipped to under $20 billion, significantly below early August levels. Ethereum volume also declined to just over $26 billion.

Lower depth means relatively small orders can trigger outsized price reactions. This environment contributes to why is crypto dumping right now, as liquidity gaps exacerbate intraday declines. Thin markets also discourage institutional participation, creating a feedback loop of lower demand and weaker support at key technical levels.

Altcoins underperform as traders cut exposure

Altcoins have faced outsized losses compared to Bitcoin. Cardano (ADA) fell over 11% on the week, Solana (SOL) dropped nearly 7%, and XRP declined almost 9%. These steep moves illustrate why is crypto going down right now, as high-beta tokens react more aggressively to bearish sentiment.

The underperformance reflects traders unwinding speculative positions amid macro uncertainty. Many of these projects also lack near-term catalysts, further weakening demand. For traders wondering why crypto is going down, the heavy selling in altcoins highlights fragility in market structure when broader sentiment turns risk-off.

What’s driving today’s crypto market decline

Today’s crypto market weakness stems from three converging factors: rising Treasury yields making risk-free assets more attractive, deteriorating liquidity conditions across major exchanges, and heavy selling pressure in altcoins as traders reduce exposure.

The combination of macro headwinds and technical factors explains why crypto is falling today. Until liquidity improves and macro sentiment stabilizes, digital assets may continue facing pressure as institutional investors favor safer alternatives over volatile cryptocurrencies.

Content on BlockPort is provided for informational purposes only and does not constitute financial guidance.

We strive to ensure the accuracy and relevance of the information we share, but we do not guarantee that all content is complete, error-free, or up to date. BlockPort disclaims any liability for losses, mistakes, or actions taken based on the material found on this site.

Always conduct your own research before making financial decisions and consider consulting with a licensed advisor.

For further details, please review our Terms of Use, Privacy Policy, and Disclaimer.