Crypto going up – here are the reasons behind it

Market cap rises 2.3% to $3.87T with ETH, SOL, and BNB leading while investors wait for Jackson Hole signals

Key points

- The crypto market is worth $3.87T, up +2.28% (24h) – roughly +$80B. Altcoins lead; Bitcoin is flat.

- Macro mood is calmer ahead of Jackson Hole; policy uncertainty is lower.

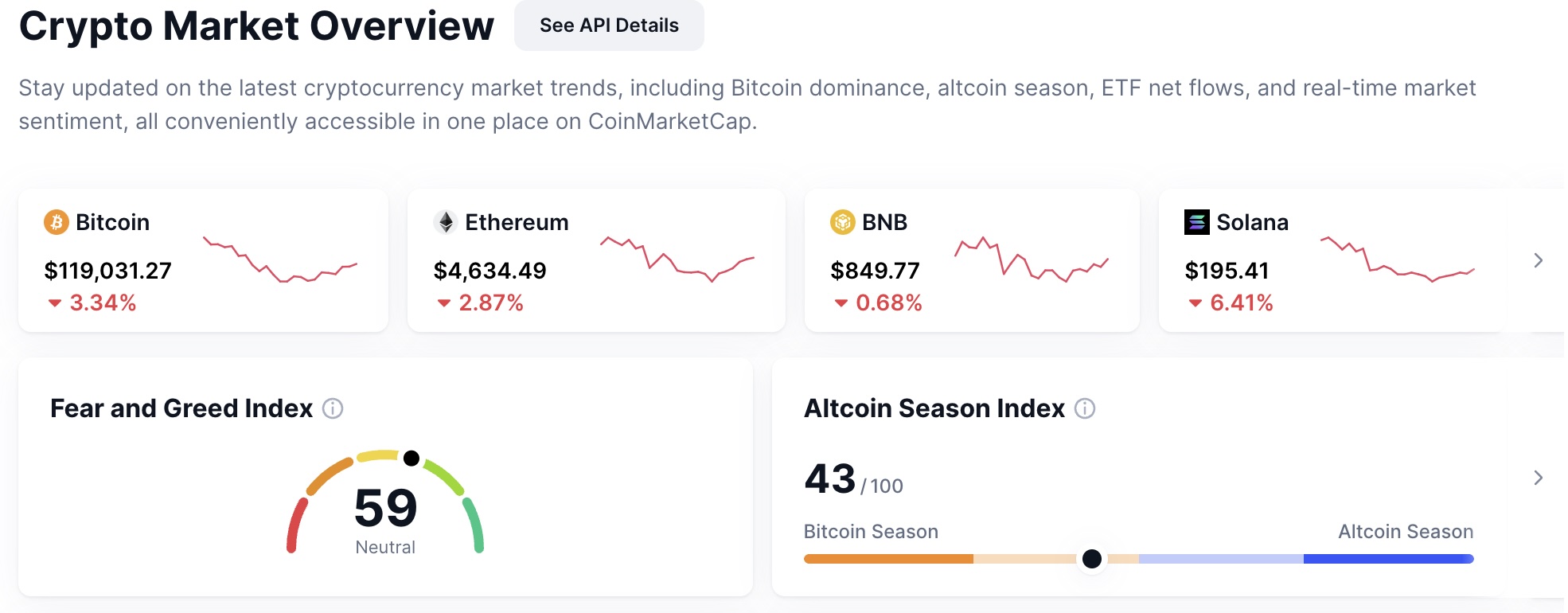

- After last week’s pullback from the $4.17T high, a neutral sentiment (Fear & Greed 50) supports a measured rebound.

August 21, 2025 – The global crypto market added about $80B in a day to $3.87T (+2.28%). Bitcoin trades near $113,950 (+0.2%), while Ethereum ($4,317; +3.38%), BNB ($862.77; +3.48%), and Solana ($187.87; +3.92%) move higher. The chart shows a steady climb rather than a spike. The Fear & Greed Index is 50 (Neutral), and 24‑hour volume is around $179.8B (slightly lower day‑over‑day). This is the context for why is crypto going up right now.

Calmer macro mood ahead of Jackson Hole

Investors are waiting for Jerome Powell’s remarks. With the dollar stable and odds of a September rate cut still discussed, there is less near‑term policy anxiety. When the macro picture is quiet, buyers are more willing to add risk. That helps explain why is crypto going up today.

Altcoins pull ahead while Bitcoin stalls

Capital is rotating into altcoins with higher daily volatility. Ether, BNB, and Solana are up 3–4% while Bitcoin is almost unchanged. Even if BTC lags, these gains lift the total market cap. This alt‑led move is a clear reason why is crypto going up despite muted bitcoin dominance during the session.

Rebound after last week’s drop and a neutral sentiment

The market recently pulled back from the yearly high of $4.17T (Aug 14, 2025). With positioning cleaner and sentiment neutral, buyers are stepping back in. Volume is not overheated, which points to a measured, not euphoric, advance. Combined, these factors explain why did crypto go up today despite key macro events still ahead.

Content on BlockPort is provided for informational purposes only and does not constitute financial guidance.

We strive to ensure the accuracy and relevance of the information we share, but we do not guarantee that all content is complete, error-free, or up to date. BlockPort disclaims any liability for losses, mistakes, or actions taken based on the material found on this site.

Always conduct your own research before making financial decisions and consider consulting with a licensed advisor.

For further details, please review our Terms of Use, Privacy Policy, and Disclaimer.