Inverse Cramer Effect Strikes Again: Why XRP and Solana Soared After TV Host’s Criticism

When iconic TV host Jim Cramer expresses crypto skepticism, markets often interpret this as a buy signal. Ripple and Solana’s success provides fresh evidence that media figure opinions frequently work in reverse.

Both XRP and SOL faced harsh criticism from Mad Money host Jim Cramer in 2022. Rather than collapsing, both tokens not only survived but delivered explosive gains exceeding 860%, becoming textbook examples of the ‘Cramer Effect.

Could community contrarianism actually outperform traditional analysis?

The Contrarian Signal: How Media Skepticism Became Crypto’s Best Buy Indicator

Classical finance theory suggests investor behavior relies heavily on fundamental analysis, macroeconomic indicators, and institutional assessments. However, cryptocurrency markets consistently demonstrate persistent divergence between expert opinions and actual asset performance.

The ‘Cramer Effect’ phenomenon has proven particularly illuminating. This relates to regular public criticism of various assets by popular financial commentator Jim Cramer. Typically, such criticism not only fails to halt asset growth but paradoxically triggers rapid appreciation.

These paradoxes raise questions about how information signals actually influence retail and institutional behavior. The pattern suggests that stronger and more categorical statements increase the likelihood of inverse market interpretation. Such reactions amplify distrust toward traditional financial experts, fostering deliberate contrarianism within crypto communities.

From ‘Giant Scam’ to 860% Gains: XRP’s Spectacular Cramer Comeback

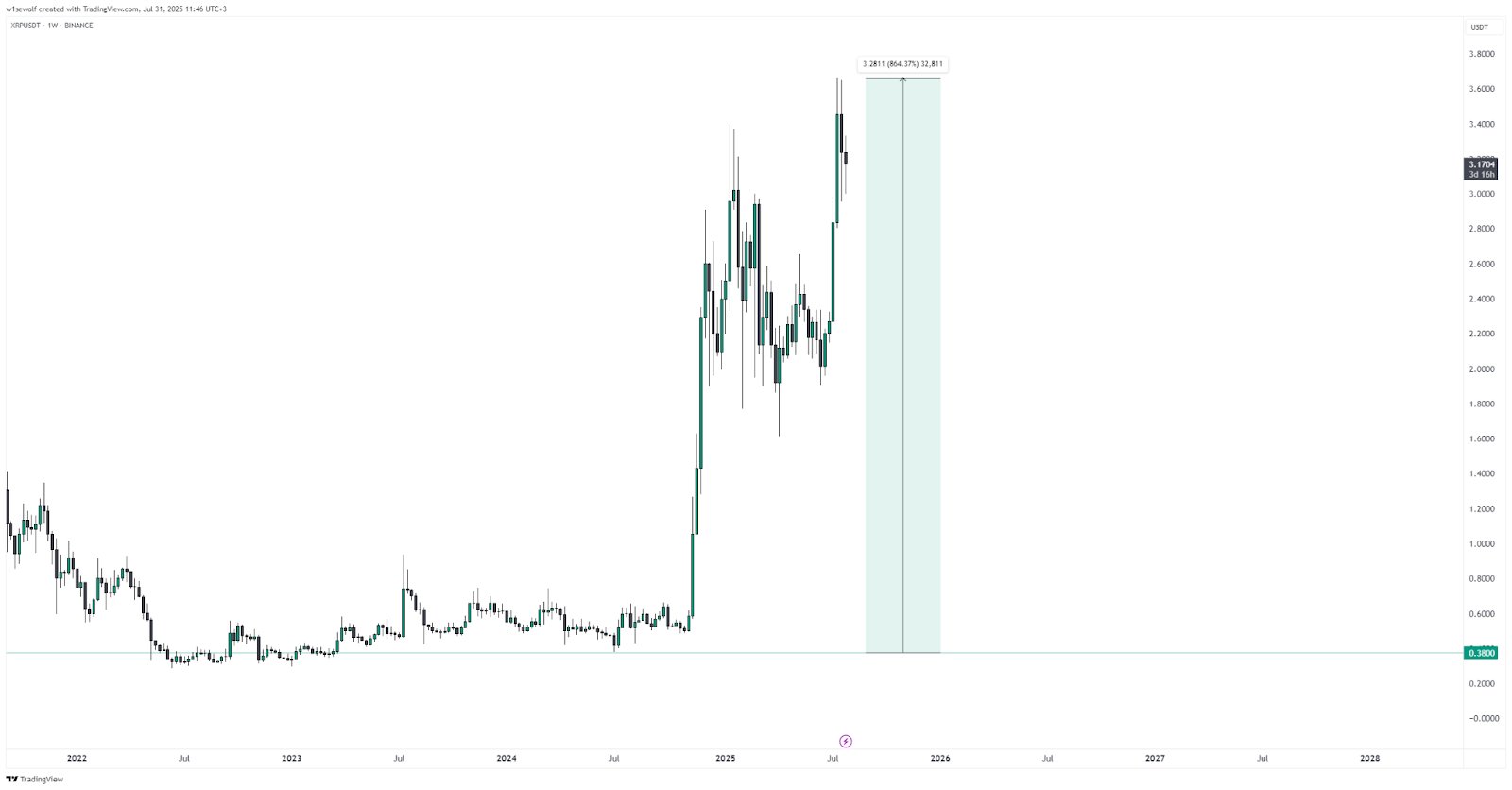

In December 2022, Jim Cramer declared on-air that he considered XRP a ‘giant scam,’ publicly questioning its value and long-term prospects. At that time, the token traded around $0.38 and faced pressure from ongoing litigation between Ripple and the SEC. However, subsequent market performance proved diametrically opposite to Cramer’s dire predictions.

XRP has surged over 860% since December 2022, reaching a peak of $3.66. This growth stems not merely from speculative interest or retail traders’ contrarian positioning. It rests on solid fundamental catalysts: Ripple’s partial legal victories, regulatory recognition in several jurisdictions that the token isn’t a security, plus active RippleNet infrastructure development and expanding partnerships in international payments.

Remarkably, Cramer’s peak skepticism coincided precisely with XRP’s local price bottom. Essentially, Jim provided the perfect buy signal.

Source: tradingview.com

This triggered explosive community response: memes, sarcastic social media posts, and calls to ‘do the opposite’ further cemented Jim Cramer’s reputation as a contrarian indicator. XRP and SOL became more than assets overcoming negative narratives – they became case studies in how markets can systematically oppose institutional forecasts.

The Inverse Cramer Playbook: Why Crypto Thrives on TV Host Pessimism

The XRP and SOL cases represent merely two episodes from an extensive series where Jim Cramer’s skeptical statements have consistently preceded dramatic asset growth. This pattern has gained established recognition in crypto communities as the “Inverse Cramer Effect,” transitioning into popular internet humor.

Among the most notable examples of Cramer’s negative assessments was Bitcoin, which subsequently demonstrated outstanding price rallies. You can easily find entire lists of assets that grew despite his public doubts.

The correlation became so pronounced that the U.S. market launched an Inverse Cramer ETF – explicitly designed to bet against the iconic TV host’s recommendations.

Naturally, it’s important to avoid overestimating such correlations: crypto markets remain multidirectional and sensitive to numerous factors. However, regular misalignment between public expertise and actual market behavior signals a clear structural gap between crypto markets and media narratives.

Contrarian Wisdom: When Doing the Opposite Pays Off

Jim Cramer’s track record with crypto markets demonstrates that critical statements from media and institutional figures often carry inverse weight. Skepticism from figures like Jim Cramer, Forbes, and Raoul Pal not only fails to halt token growth but feeds mass contrarianism, where public negativity becomes a bullish signal.

This phenomenon suggests that following authoritative opinions isn’t always profitable. Sometimes the winning strategy is simply doing the opposite.

Content on BlockPort is provided for informational purposes only and does not constitute financial guidance.

We strive to ensure the accuracy and relevance of the information we share, but we do not guarantee that all content is complete, error-free, or up to date. BlockPort disclaims any liability for losses, mistakes, or actions taken based on the material found on this site.

Always conduct your own research before making financial decisions and consider consulting with a licensed advisor.

For further details, please review our Terms of Use, Privacy Policy, and Disclaimer.