CME’s Record July Shows Institutions Are Driving the Altcoin Market

Institutional investors are no longer on the sidelines. CME’s July data reveals that altcoins like Solana, XRP, and Ether are becoming core assets in regulated crypto portfolios.

CME trading data from July 2025 marks a turning point in the evolution of the crypto market. Institutional investors are now at the forefront, gradually replacing retail traders as the dominant force in regulated derivative trading, particularly in altcoin futures.

Amid increased volatility and clearer regulatory frameworks, CME reported record volumes and open interest across multiple products. This signals a deeper institutional commitment to digital assets, reflecting a more mature and strategically driven market structure.

Record-Breaking Growth at CME: A Macrometric Shift

In Q2 2025, CME Group saw a 140% year-over-year rise in crypto trading volume, with daily notional volume averaging $10.5 billion. Open interest reached 217,000 contracts, totaling over $21 billion, signaling steady participation beyond short-term trading.

These numbers point to more than a passing surge. They mark a structural shift in crypto derivatives, with institutional investors not just entering the market but defining its direction. The growth reflects rising confidence in regulated platforms and strong demand for advanced risk management tools.

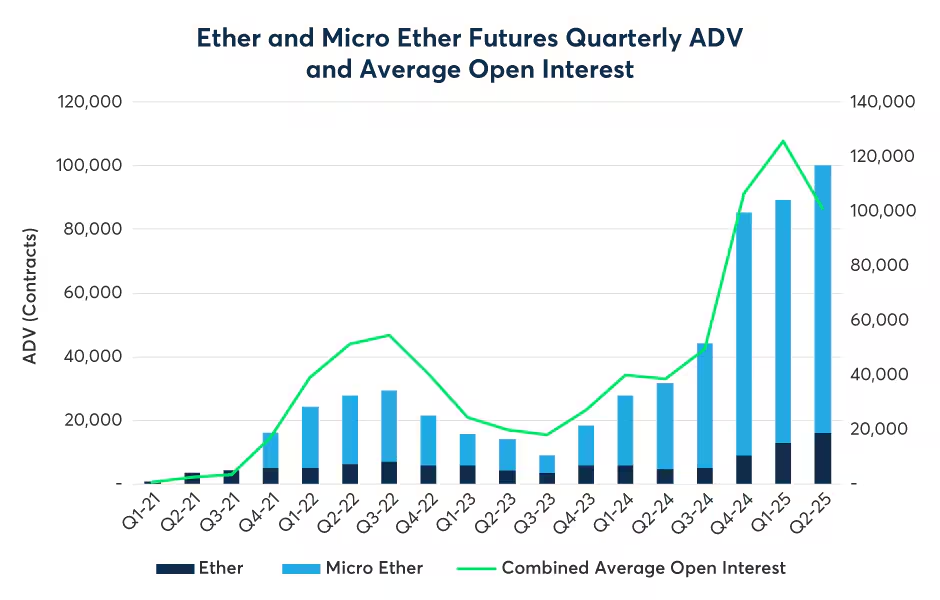

Ether Leads the Charge: Institutional Demand Amid Price Divergence

Although Ether’s price fell 25% year-to-date, institutional demand for ETH derivatives climbed. In Q2 2025, CME reported average record daily volumes: 16,200 contracts for Ether futures and 83,800 for Micro Ether. Open interest also hit a record high of 27,900 contracts, totaling $3.4 billion in notional value.

This surge aligned with a 30% rebound in the Ether/Bitcoin ratio from its April low. The ratio’s movement fueled interest in relative value strategies, with CME’s Ether/Bitcoin Ratio (EBR) futures offering a direct, efficient way to trade the spread.

SOL and XRP Futures: Altcoins Enter the Institutional Arena

In July 2025, CME’s Solana and XRP futures recorded $6.5 billion and $6 billion in trading volume. Launched only months earlier, they quickly became two of the exchange’s most actively traded new products, reflecting strong institutional demand.

This surge signals a broader shift in institutional strategy. Investors are moving beyond Bitcoin and Ether, targeting regulated altcoins that offer liquidity and depth. CME’s USD-settled contracts provide exposure without the need to hold the underlying assets, lowering operational risk.

The adoption of SOL and XRP futures marks a turning point. Altcoins are no longer fringe assets. They are now core elements in institutional crypto portfolios, supported by regulated infrastructure and consistent liquidity.

Beyond Trading Volume: New Products and Strategic Participation

CME’s product design continues to draw institutional interest. The launch of Spot-Quoted Futures for Bitcoin and Ether in mid-2025 gives traders access to futures that mirror spot pricing without requiring monthly rollovers. These contracts improve capital efficiency and suit long-term strategies.

CME also offers tools like Trade at Settlement (TAS) and Basis Trade at Index Close (BTIC), which let traders enter positions at a fixed spread to the settlement or index price. In Q2 2025, TAS volumes for Bitcoin and Ether futures averaged more than 3,000 contracts per day, reflecting steady institutional use.

By removing the need to hold crypto directly, these products help reduce custody and counterparty risk. CME’s regulated, flexible instruments make it a central venue for institutions seeking precision and scale in crypto markets.

CME’s July 2025 data highlights a decisive turn in crypto market dynamics. The record volumes, rising open interest, and adoption of advanced trading tools reflect a market shaped by strategy rather than sentiment. This shift marks the institutionalization of altcoins and signals a broader maturity phase for the digital asset ecosystem.

Content on BlockPort is provided for informational purposes only and does not constitute financial guidance.

We strive to ensure the accuracy and relevance of the information we share, but we do not guarantee that all content is complete, error-free, or up to date. BlockPort disclaims any liability for losses, mistakes, or actions taken based on the material found on this site.

Always conduct your own research before making financial decisions and consider consulting with a licensed advisor.

For further details, please review our Terms of Use, Privacy Policy, and Disclaimer.