Balancing privacy and law in Web3: Why ZK-proofs matter for the future of blockchain

Can complete user privacy coexist with regulatory compliance and trust? Lately, the answer has increasingly been no. But ZK-proof technology opens a path to the “golden middle” for the crypto industry.

The story of cryptocurrency mixer Tornado Cash became a turning point for the crypto industry: regulators saw privacy as a threat, while users viewed it as their last defense of freedom. This created a false dilemma: anonymity versus legality.

This article explains why such framing is wrong and shows how Zero-Knowledge proofs (ZK-proofs) offer a ‘third way’ – technology that simultaneously preserves user confidentiality while giving regulators tools to fight crime.

Tornado Cash and the false privacy dilemma

The Tornado Cash saga became a watershed moment in blockchain privacy discussions. The trial of co-founder Roman Storm demonstrated that for regulators, private transactions aren’t user protection tools but threats that facilitate money laundering and sanctions evasion.

The case against Tornado Cash was built on the premise that mixing services obscure fund origins and destinations, allegedly facilitating criminal activity. This trial cemented a false dichotomy in public discourse: society has only two paths – either absolute anonymity carrying abuse risks, or complete transparency that destroys the very concept of financial confidentiality.

Tornado Cash became a symbol of this struggle. For users, it represented the right to personal freedom and data protection. For authorities, it posed a threat where privacy equals criminality. This artificial dilemma frames the ongoing discussion about whether a “third way” exists.

Enter zero-knowledge proofs: privacy without opacity

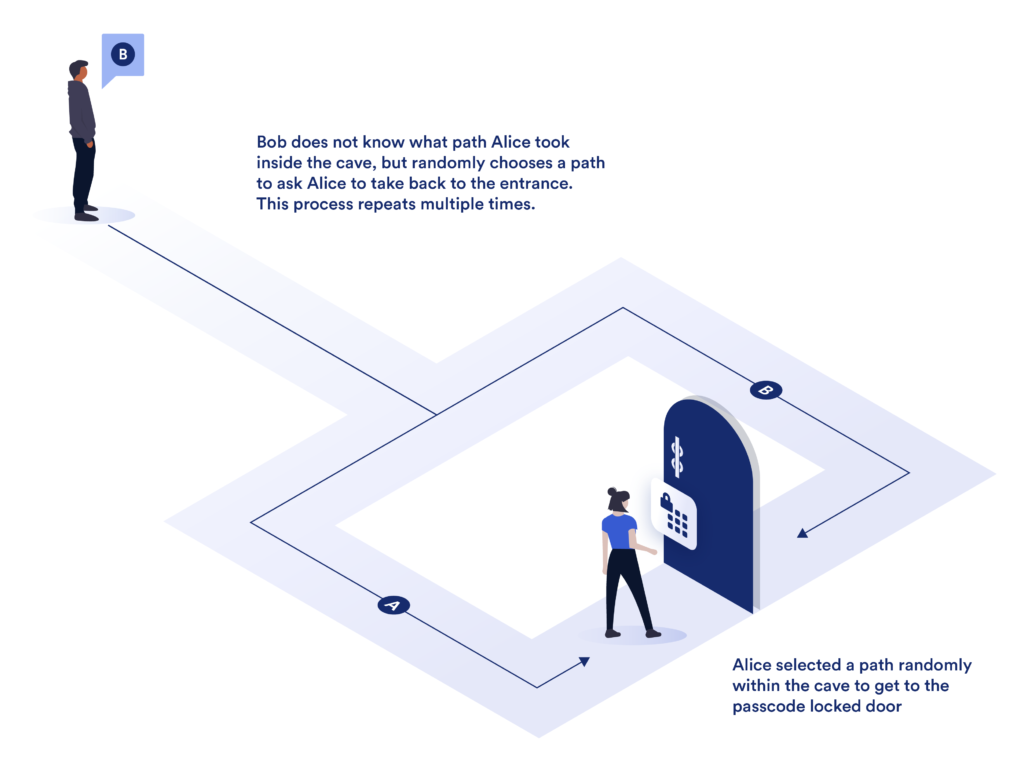

Zero-Knowledge Proofs (ZK-proofs) are a cryptographic technique that allows proving the truth of a statement without revealing underlying data. Imagine wanting to confirm you’re over 18 without showing your passport with name, birth date, and address. A ZK-proof would verify the fact without exposing additional information.

Several technical implementations exist: zk-SNARKs, zk-STARKs, and Bulletproofs. They differ in speed, resource requirements, and resistance to potential attacks. But they share one feature – the ability to provide verification guarantees without full data disclosure.

The key advantage for crypto markets is that users can confirm transaction legitimacy while maintaining privacy details. For blockchain, this means new quality: transparency for regulators and security for individuals. This feature allows avoiding the sacrifice of confidentiality for crime fighting.

A16z and the case for a “third way”

Venture firm A16z builds its argument around ZK-proofs: the crypto industry doesn’t have to choose between total anonymity and complete surveillance. In their view, modern cryptographic methods enable combining user privacy with effective illegal activity control. This is the “third way” that destroys the myth of impossible compromise.

The key element of this model is so-called cash-out points. Users don’t have to reveal entire transaction histories but can prove their assets aren’t linked to laundering or sanctioned addresses. Thus, law-abiding fund holders can safely interact with banks and exchanges while maintaining confidentiality control.

A16z’s position has support from some regulatory representatives. SEC Commissioner Hester Peirce (known as “Crypto Mom”) noted that the crypto industry needs tools that protect users without abandoning privacy. In this context, ZK-proofs become a bridge between government requirements and users’ basic rights to financial freedom.

From compliance to identity: broader applications of ZK-proofs

Zero-Knowledge Proofs have long transcended simple financial transactions. They can be applied in various scenarios where confirming facts without revealing sensitive data matters.

In corporate environments, ZK-protocols already find application. For example, JPMorgan Nexus uses them for interbank settlements and tokenized transfers. This allows banks to verify operation correctness without revealing internal data.

In Web3 and DeFi, these technologies enable implementing KYC/AML procedures without requiring users’ complete personal data packages. Regulators gain confidence in fund legitimacy while users retain privacy and control.

Critics often point to ZK-proofs’ complexity and high computational costs. For a long time, this genuinely limited their application: proof generation and verification consumed too many resources, making mass adoption unrealistic.

However, the situation has changed in recent years. Optimizations in zk-SNARKs and zk-STARKs have significantly reduced generation time and computational costs. Moreover, new approaches eliminate the need for “trusted setups,” enhancing protocol security and transparency.

Today, these technologies are moving beyond theory. The Ethereum ecosystem actively implements zk-rollups – layer-2 solutions that process thousands of transactions off the main network and confirm them using ZK-proofs. This dramatically improves scalability, reduces fees, and demonstrates the technology’s readiness for real-world use.

The ‘impossibility of scaling’ argument is gradually losing relevance as the industry tests and applies ZK-protocols in practice.

Why the industry must embrace privacy now

Privacy in the digital economy isn’t a luxury or abuse tool but a user’s basic right and trust foundation. Without it, blockchain becomes a space of total transparency where every transaction is visible to everyone, including competitors, fraudsters, and governments. But ignoring regulatory requirements is also impossible: the industry has learned that projects not fitting legal frameworks risk repeating Tornado Cash’s fate.

Zero-Knowledge Proofs offer a rare chance for compromise. They can confirm fund origin legitimacy or user action legitimacy without revealing excess data. This satisfies both sides: users maintain confidentiality control while regulators get necessary guarantees for fighting crime.

If the industry doesn’t take initiative and implement such solutions, governments will continue shutting down services, perceiving privacy as a threat. This would harm not only financial privacy rights but trust in the blockchain concept itself.

ZK-proofs represent that ‘golden middle’: they give the market a chance to mature, transition from confrontation to cooperation with regulators, and build infrastructure where privacy and legality go hand in hand.

The path forward

The Tornado Cash story revealed the limits of the old approach: either absolute anonymity with abuse risks or complete transparency destroying privacy. Such dichotomy leads the industry to a dead end and provokes conflicts with governments.

Zero-knowledge proofs open a third way, enabling a crypto-economy where privacy becomes not a cover for crime but a tool for trust, security, and mature regulatory interaction. The question isn’t whether we can afford privacy – it’s whether we can afford to lose it.

As the industry stands at this crossroads, embracing ZK-proofs isn’t just a technical choice – it’s a strategic decision that could determine whether blockchain technology fulfills its promise of financial freedom while earning regulatory acceptance.

Content on BlockPort is provided for informational purposes only and does not constitute financial guidance.

We strive to ensure the accuracy and relevance of the information we share, but we do not guarantee that all content is complete, error-free, or up to date. BlockPort disclaims any liability for losses, mistakes, or actions taken based on the material found on this site.

Always conduct your own research before making financial decisions and consider consulting with a licensed advisor.

For further details, please review our Terms of Use, Privacy Policy, and Disclaimer.