URGENT: Binance Slashes Altcoin Leverage – Your Portfolio at Risk

The world’s largest crypto exchange Binance is updating collateral coefficients for altcoins within Portfolio Margin. We’ll explore what this means for traders, why platforms do this, and how the market typically reacts to such changes.

Binance has implemented dramatic collateral coefficient changes across multiple altcoins, with some requirements jumping by 67%. Multiple waves of changes have already hit traders (July 15, 18, 29, and August 1, 2025), and many are reporting unexpected liquidation risks.

The adjustments affect assets like LDO, NEO, DYDX, and TRUMP, increasing their required collateral ratios. According to Binance CEO Richard Teng, these steps aim to reduce liquidation risks amid volatility, rather than being driven by liquidity issues or regulatory pressure.

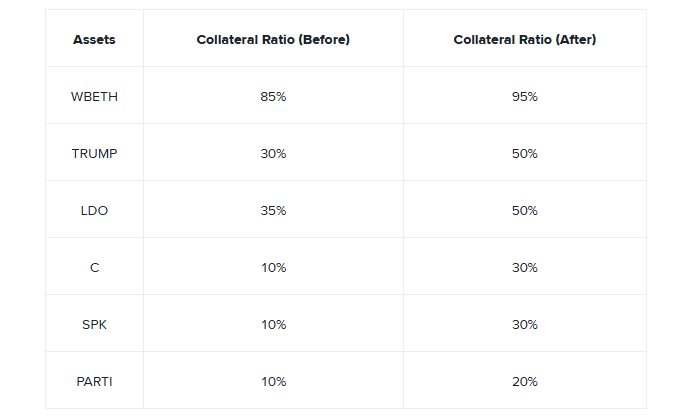

The Numbers: Which Assets Got Hit Hardest

The ratio increases have created immediate impact across multiple tokens. TRUMP saw its collateral requirement jump from 30% to 50% (a 67% increase), while LDO rose from 35% to 50% (43% increase) and WBETH climbed from 85% to 95% (12% increase).

However, Binance’s policy doesn’t apply universally to all assets. Some coefficients are actually being reduced. For instance, starting August 1st, the collateral value of NEO and IOTX tokens will drop from 55% to 45% and 40% respectively. Similar reductions affect MANA, KSM, SNX, and DYDX – their collateral ratios will decrease by an average of 10-15%.

Major cryptocurrencies like BTC and ETH remain unchanged – the exchange maintains their stable status within the margin lending system.

The Strategy Behind the Squeeze

Revising collateral coefficients is part of regular risk management strategy. Against the backdrop of increased crypto market volatility and instability in individual altcoins, exchanges are strengthening protective mechanisms against mass liquidations.

Raising minimum margin requirements helps reduce the potential domino effect, where forced closure of one position could trigger a cascade of liquidations across multiple leveraged accounts.

Binance CEO Richard Teng emphasized that the changes aren’t related to liquidity shortages or financial pressure on the platform. According to him, the goal is ensuring system stability amid uncertain market conditions and compliance with global regulatory frameworks. The exchange calls this approach proactive and institutionally mature.

Critical Impact on Your Trading

The updates affect users with activated Portfolio Margin and Unified Account modes. Higher collateral coefficients directly slash your uniMMR (unified maintenance margin ratio) – the metric that determines if you’ll get liquidated. Even if asset prices haven’t changed, maintaining the same position sizes could create a collateral deficit.

This increases the risk of forced liquidation. If uniMMR falls below acceptable levels, the system will automatically close positions, starting with the least efficient ones. Those holding large portions in assets with reduced collateral value – such as NEO, IOTX, MANA, or DYDX – are particularly vulnerable.

To minimize risks, users should review their portfolios in advance and make adjustments. Binance didn’t introduce a transition period – new coefficients take effect strictly on schedule, and last-minute reactions might not be sufficient.

Immediate Action Plan:

- Priority 1: сheck current uniMMR value in your account dashboard

- Priority 2: reduce leverage on affected high-volatility assets

- Priority 3: add emergency funds to your margin account to create stability buffers

This approach will help adapt to new conditions and avoid unexpected losses amid the exchange’s tightening requirements.

Altcoins Under Scrutiny: A Signal of Institutional Caution

The nature of Binance’s adjustments indicates a selective strategy: requirements are primarily being tightened for altcoins with limited liquidity or unstable price history. This includes both relatively new tokens (like SPK or PARTI) and more established but volatile assets like TRUMP or MANA.

Such an approach may reflect the platform’s growing desire to build barriers against high-risk exposure.

As a result, Binance is creating a trust system where highly liquid and institutionally significant assets (BTC, ETH) maintain previous parameters, while less stable tokens face stricter frameworks.

This differentiated approach to requirements strengthens the margin lending ecosystem and reduces systemic risks in case of market shock. It also aligns with global regulatory trends, where emphasis shifts from universality to targeted risk management.

What’s Next: Regulatory Practice or the Beginning of a Crackdown?

Based on the pace and nature of changes, Binance is establishing a new norm for handling margin risks. Instead of emergency interventions – planned reviews, announced in advance and technically feasible. This demonstrates the exchange’s commitment to operating like mature financial infrastructure, where risk management isn’t reactive but a continuous process.

Most likely, such updates will become a regular part of the Portfolio Margin ecosystem. Amid global volatility and growing regulatory attention, Binance remains committed to a flexible system with adaptive parameter adjustments.

Binance isn’t trying to hurt traders – it’s preventing a systemic collapse that would hurt everyone. Smart traders will adapt their strategies accordingly, while those who ignore these signals may find themselves forcibly liquidated when volatility strikes.

Content on BlockPort is provided for informational purposes only and does not constitute financial guidance.

We strive to ensure the accuracy and relevance of the information we share, but we do not guarantee that all content is complete, error-free, or up to date. BlockPort disclaims any liability for losses, mistakes, or actions taken based on the material found on this site.

Always conduct your own research before making financial decisions and consider consulting with a licensed advisor.

For further details, please review our Terms of Use, Privacy Policy, and Disclaimer.