Travel Rule Crypto: Balancing Privacy and Regulation in the Digital Age

The Crypto Travel Rule is a recommendation by the Financial Action Task Force (FATF) as a measure to fight money laundering and terrorist financing through virtual assets.

Originally applied to traditional finance, the Travel Rule requires financial institutions to collect and share certain customer information to help track and prevent illegal activities. In 2019, the Financial Action Task Force (FATF) recommended extending the rule to virtual assets and virtual asset service providers (VASPs), such as crypto exchanges and trading platforms.

In this article, we’ll cover the progress of the Crypto Travel Rule implementation across different jurisdictions and its possible effects on the crypto market.

Overview of the Original FinCEN Travel Rule

Among the many regulations aimed at combating financial crime, one often mentioned is the Travel Rule. So, what is the Travel Rule, and why does it matter?

The Travel Rule is a specific regulation under the Bank Secrecy Act (BSA), introduced by the U.S. Financial Crimes Enforcement Network (FinCEN) in 1996, with further guidance issued in 1997. According to FinCEN, the rule requires all financial institutions, including banks, brokers, and dealers, to transmit certain information to the next financial institution when transferring funds of $3,000 or more. This includes details such as the sender’s and recipient’s names, addresses, and account numbers.

Travel Rule compliance ensures that this information “travels” with the transaction from one financial institution to another. This allows authorities to trace the origin and destination of funds if suspicious activity is suspected.

This rule was created to ensure that in criminal investigations, as well as tax or regulatory proceedings, sufficient information would be available to quickly enable authorities to determine the source of the transmittal of funds and its recipient,

FinCEN notes.

In 2020, the regulator proposed lowering the Travel Rule threshold from $3,000 to $250 for international transactions. However, the threshold remains unchanged for now.

FATF Guidelines for the Travel Rule: What They Mean for Virtual Assets

In 2019, the Financial Action Task Force (FATF) recommended expanding FinCEN’s Travel Rule to cover virtual assets and virtual asset service providers (VASPs). FATF is an independent international watchdog that combats money laundering and terrorist financing by developing global recommendations and standards. Although FATF has no power to enforce laws, its recommendations are widely influential and often adopted through national legislation.

In Recommendation 15, which focuses on new technologies, FATF states that countries and financial institutions should manage the risks associated with virtual assets. Under the Travel Rule (part of Recommendation 16, titled Wire Transfers), they are required to ensure that VASPs are regulated for anti-money laundering (AML) and counter-terrorist financing (CFT) purposes.

Countries should ensure that VASPs obtain and hold required and accurate information on virtual asset transfers, submit that information to the beneficiary VASP or financial institution immediately and securely, and make it available on request to appropriate authorities,

– FATF.

In October 2021, FATF released revised guidance clarifying which entities fall under its Travel Rule requirements. According to the guidelines, crypto exchanges, money transmitters, and custodial platforms meet the definition of VASPs. These providers must be licensed or registered and meet the compliance standards of the country in which they operate.

FATF defines virtual assets (VAs) as digital representations of value that can be digitally traded or transferred and used for payment or investment purposes. Stablecoins, utility tokens, and certain DeFi platforms may also fall under the scope, depending on their structure and function. NFTs are generally not considered virtual assets under the FATF definition unless they exhibit characteristics that would require separate regulatory consideration.

Travel Rule Threshold Explained With Examples

The Financial Action Task Force (FATF) recommends that countries apply a threshold of USD/EUR 1,000 for occasional virtual asset transfers. The $3,000 threshold used in traditional finance under the original Travel Rule has been lowered to $1,000 for virtual asset transfers under FATF guidance. This change reflects the higher risks associated with virtual assets, such as global reach, increased anonymity, and rapid settlement.

While FATF recommends a $1,000/€1,000 de minimis threshold, various countries have implemented their own rules for the crypto Travel Rule.

- USA – $3,000: FinCEN applies the Funds Travel Rule to transactions involving convertible virtual currencies (CVCs), based on its 2019 guideline.

- Canada – 1,000 CAD: This amount is defined by the Proceeds of Crime (Money Laundering) and Terrorist Financing Regulations, introduced in 2019.

- European Union – €1,000: The EU’s Transfer of Funds Regulation extended traditional finance rules to crypto, aligning with FATF standards. Crypto asset service providers (CASPs) must report any transaction over €1,000.

- Dubai – 3,500 AED: Dubai’s Virtual Assets Regulatory Authority sets the threshold at AED 3,500. This framework applies only to Dubai, not other emirates.

- Japan – ¥0: Japan initially applied a temporary threshold of ¥100,000 under guidance from the Japan Virtual and Crypto Assets Exchange Association (JVCEA). However, with the full enforcement of the revised Act on Prevention of Transfer of Criminal Proceeds (APTCP) on June 1, 2023, Japan eliminated this threshold. Now, transmission information is required for all transactions, regardless of the amount.

If a transaction meets or exceeds the threshold, VASPs must perform Customer Due Diligence (CDD). This includes verifying the customer’s identity and collecting key details about both the sender (originator) and receiver (beneficiary), such as:

- the name of the originator;

- the originator account number where such an account is used to process the transaction;

- the originator’s address, or national identity number, or customer identification number, or date and place of birth;

- the name of the beneficiary;

- the beneficiary account number where such an account is used to process the transaction.

In high-risk transactions, additional information may be required. This includes:

- the purpose of transaction or payment;

- details about the nature, end use, or end user of the item;

- proof of funds ownership;

- parties to the transaction and the relationship between parties; sources of wealth and/or funds;

- the identity and the beneficial ownership of the counterparty; and g. export control information, such as copies of export-control or other licenses

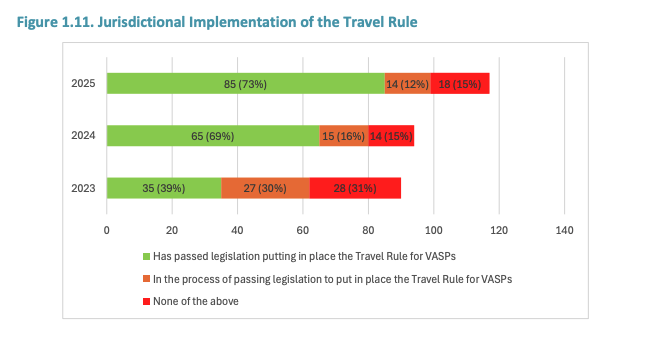

According to FATF’s 2025 survey, 73% of respondents (85 out of 117 jurisdictions) have passed Travel Rule legislation. The number of jurisdictions rose from 65 in 2024 to 85 in 2025. Another 14 are in the process of implementation.

Understanding Travel Rule Data Transfers

The VASP Travel Rule requires crypto platforms to share certain customer information when transferring digital assets.

This process involves several steps. First, the sending platform – called the originator VASP – checks whether the transaction is being sent to another regulated platform. If it is, the Travel Rule applies. The next step is identifying the receiving platform, known as the beneficiary VASP. To do this, the originator may use public registries or lists of verified platforms.

Once the beneficiary is identified, the originator must ensure it’s a trustworthy and regulated entity. This could involve checking for past legal issues, reviewing news reports, or asking the platform to fill out a due diligence questionnaire.

After this verification, the originator VASP sends the required information, such as names and account numbers, to the beneficiary VASP. Only then can the transaction proceed. This process helps prevent money laundering and improves the security of crypto transfers.

FATF’s VAPS Travel Rule applies to centralized entities like crypto exchanges, custodial wallet providers, and similar businesses. However, the organization also notes risks in decentralized use cases, as tools and methods that increase anonymity in virtual asset transfers continue to evolve. According to FATF, countries must address the risks of decentralization and peer-to-peer (P2P) transactions by taking proper mitigation measures.

These include identifying DeFi projects that meet the definition of a VASP, developing regulatory frameworks, enforcing compliance, and monitoring market activity using real-time analytics tools. FATF also encourages public-private sector collaboration and international cooperation to combat crypto-related fraud and scams. It recommends monitoring various activities and accessing transaction data from services, including unhosted wallets, when necessary.

How the Crypto Travel Rule Affects Users

The Crypto Travel Rule is meant to bring more transparency, but it also impacts individual users, affecting privacy, adoption, and the core idea of decentralization.

Impact on Adoption

The implementation of the Bitcoin travel rule and its application to other cryptocurrencies can be a double-edged sword for adoption. On one hand, by aligning the crypto industry with traditional financial standards, the Travel Rule may increase trust among institutional investors and encourage broader market participation. Increased transparency could make crypto a more attractive option and potentially drive greater mainstream adoption.

However, for individual users, especially those new to crypto, the added requirements can be a barrier. Having to provide detailed personal information for transactions, even relatively small ones, introduces friction and complexity. This might deter some potential users, particularly those who were drawn to crypto for its perceived anonymity and ease of use compared to traditional banking. Different implementation timelines across countries also create confusion, especially for cross-border transfers.

Impact on Privacy Coins

The travel rule cryptocurrency fundamentally challenges the pseudonymous nature of the crypto market. In particular, it creates difficulties for privacy-focused coins like Monero (XMR) and Zcash (ZEC). These “privacy coins” are specifically designed to hide transaction details, making it difficult to trace sender, receiver, and transaction amounts. The core functionality of these coins directly conflicts with the Travel Rule’s mandate for transparency and traceability.

While the Travel Rule primarily targets VASPs, the increased regulatory scrutiny could lead to delisting of privacy coins from regulated exchanges, making them harder for users to acquire and trade. Wallet providers and custodial platforms may also restrict support, further limiting their utility. This could push their usage towards more decentralized or unregulated platforms, potentially making them less accessible for mainstream users but still available to those who prioritize privacy above all else. Some jurisdictions may even move to ban anonymous crypto accounts and privacy coins altogether, further restricting user choice and access.

As a result, developers behind privacy projects may need to explore hybrid models that offer some transparency without fully compromising user privacy. Meanwhile, the debate continues over whether financial privacy is a right or a regulatory loophole.

Impact on Decentralization

The Travel Rule primarily targets centralized entities that act as intermediaries in crypto transactions. It largely does not apply to transactions between non-custodial wallets or direct peer-to-peer transactions. This distinction could inadvertently drive users away from centralized exchanges and towards decentralized alternatives. If users can bypass VASP requirements by transacting directly or through decentralized protocols, it could inadvertently strengthen the decentralized aspects of the crypto ecosystem. However, to maintain their regulatory exemption, decentralized platforms will need to prove that they are genuinely decentralized in governance, control, and operations – otherwise, they risk falling within the scope of the Travel Rule.

For smaller VASPs and startups, compliance with the Travel Rule introduces large operational costs and complexities. They must invest in new technologies and personnel to collect, verify, and transmit the required information securely. This increased regulatory burden could favor larger, well-established institutions that have the resources to implement robust compliance frameworks, potentially stifling innovation and competition within the crypto industry.

Overall, the Crypto Travel Rule aims to improve security but changes how people use crypto. Many countries have already adopted the rule or are considering it as part of their regulatory approach. It brings more identity checks, creates new privacy concerns, and puts pressure on privacy-focused coins, which could disappear from regulated platforms. At the same time, it might push more users toward fully decentralized tools to avoid these rules. In the long run, finding the right balance between regulation, privacy, and innovation will remain a tricky challenge for crypto.

List of Sources

- Funds “Travel” Regulations: Questions & Answers (1997): United States Department of the Treasury Financial Crimes Enforcement Network

- A Proposed Rule by the FinCEN to modify the Travel Rule threshold in 2020: www.federalreserve.gov

- The FINANCIAL ACTION TASK FORCE (FATF) recommendations, updated in 2025: www.fatf-gafi.org

- FATF’s updated guidance for a risk-based approach (October 2021). www.fatf-gafi.org

- FinCEN’s Regulations to Certain Business Models Involving Convertible Virtual Currencies (May 2019): fincen.gov

- Proceeds of Crime (Money Laundering) and Terrorist Financing Regulations Document (2019): Government of Canada

- Japan Virtual and Crypto Assets Exchange Association’s Travel Rule guidance (2022): jvcea.or.jp

- Japan’s revised Act on Prevention of Transfer of Criminal Proceeds (APTCP) (2023): Japan Financial Intelligence Center

Content on BlockPort is provided for informational purposes only and does not constitute financial guidance.

We strive to ensure the accuracy and relevance of the information we share, but we do not guarantee that all content is complete, error-free, or up to date. BlockPort disclaims any liability for losses, mistakes, or actions taken based on the material found on this site.

Always conduct your own research before making financial decisions and consider consulting with a licensed advisor.

For further details, please review our Terms of Use, Privacy Policy, and Disclaimer.