How blockchain technology in real estate is building the future of ownership

Blockchain’s ability to record property ownership opens new doors in real estate, from financial transactions to improved data access.

On this page

- The potential of blockchain-powered smart contracts to transform real estate

- Why blockchain technology is set to disrupt real estate

- Key benefits and growth opportunities offered by blockchain

- How tokenization actually works: A step-by-step breakdown

- Challenges and considerations in adopting blockchain in real estate

- Common questions investors ask

Blockchain can change the way we interact with real estate. Turning properties into digital tokens on the blockchain allows tracking their history, fractional investment, and lower administrative costs, among other benefits.

The potential of blockchain-powered smart contracts to transform real estate

Smart contracts, self-executing digital agreements on blockchain, automate financial transactions such as lending, sales, and ownership transfers. For example, a property can be represented on-chain as an NFT, a unique digital token that holds information like square footage and ownership records. Smart contracts simplify real estate transactions by eliminating the need for intermediaries and automatically executing agreements based on predefined conditions. Once the conditions are met – such as payment, transferring a property share, or completing a service, the contract automatically carries out the deal.

Smart contracts can also boost liquidity in real estate. Normally, property is hard to trade because it requires time, paperwork, and large sums of money. With blockchain and real estate, smart contracts make it easier to divide properties into smaller shares. Imagine breaking down a $5 million building into hundreds of digital shares, each small enough for an average investor to afford. This democratization of investment opens the real estate market to a wider pool of investors, who can now buy a small stake in a high-value property.

The market for tokenized real estate has been growing and gaining mainstream adoption. In July 2025, MUFG, Japan’s largest bank, acquired a high-rise building in Osaka for over $681 million, announcing plans to create digital securities from the asset, which will be sold to both institutional and retail investors.

Earlier, in May 2025, the Dubai Government launched a tokenized real estate platform allowing investors to purchase fractional ownership in Dubai.

Why blockchain technology is set to disrupt real estate

Real estate on blockchain is about to change how we handle property deals in ways most people haven’t seen coming. This technology acts like a digital ledger that cannot be tampered with, making property transactions more secure and transparent than ever before.

Traditional real estate deals involve multiple middlemen, mountains of paperwork, and weeks of waiting. Blockchain eliminates much of this friction by creating smart contracts that automatically execute when conditions are met. Imagine buying a house where the deed transfers instantly once payment clears, without lawyers, banks, or title companies slowing things down.

The technology also handles complex payments quickly and efficiently. Transactions settle within minutes, including payments from other countries that normally take up to two days through banks. This removes the guesswork about when money will actually arrive. Property owners can even program automatic payments that trigger when certain conditions happen, like transferring extra funds to a savings account once rental income hits a specific amount.

Key benefits and growth opportunities offered by blockchain

By using blockchain for real estate transactions, tokenization offers benefits that make investing in property easier and more practical for everyone.

- Faster trading: real estate investing used to mean being stuck with your investment for ages. Traditional property deals can drag on for months with endless paperwork and waiting around. Digital tokens change this completely; you can buy and sell property shares instantly, just like trading stocks online. No more sitting around hoping someone will eventually buy your investment.

- Transparency and Security: everything happens out in the open with blockchain. All transactions get recorded permanently, where everyone can see them, making fraud nearly impossible. Smart contracts handle the boring stuff automatically – collecting rent, paying expenses, and distributing profits to investors without any human mistakes.

- Lower entry barrier: the traditional system only worked for wealthy people who could afford entire buildings. Now, anyone can own a piece of expensive real estate with just a few hundred dollars. A person in Texas can invest in a luxury hotel in Dubai or an office building in London without needing a fortune or leaving their home.

- Reduced Transaction Costs: by cutting out brokers, lawyers, and other middlemen, tokenization dramatically reduces the fees involved in real estate deals. Traditional property transactions involve many expensive steps, but blockchain streamlines everything into a simpler, cheaper process.

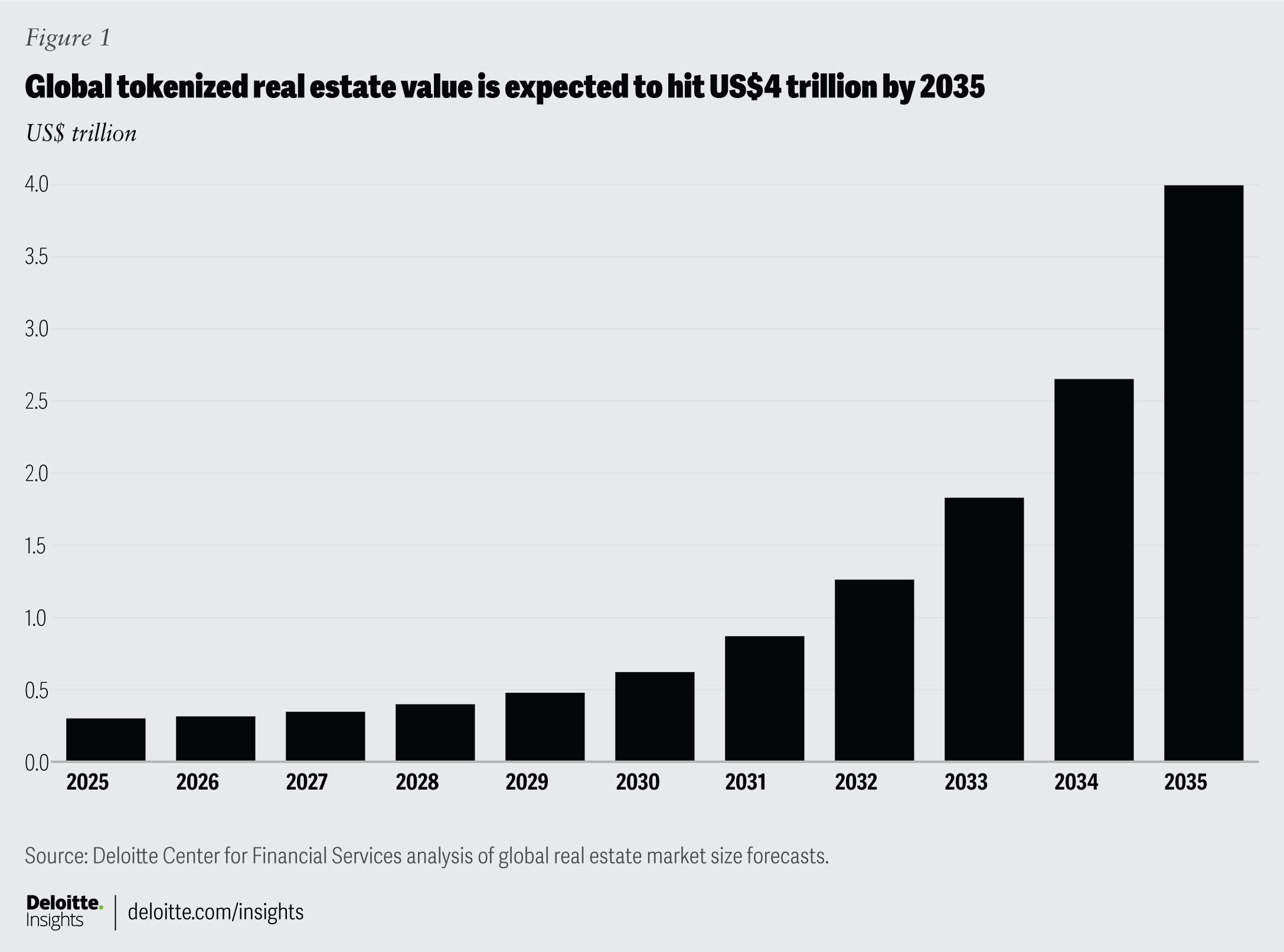

As tokenized real estate gains momentum thanks to its benefits, Deloitte predicts the market could reach $4 trillion by 2035.

How tokenization actually works: A step-by-step breakdown

Understanding blockchain technology in real estate becomes clearer when you see the actual process. Here’s how a property gets tokenized in practice:

Step 1: Property evaluation and legal setup. First, the property gets professionally appraised to determine its market value. Then, a legal entity (usually an LLC or trust) is created to hold the actual property title. This step is crucial because you can’t directly own “blockchain tokens of a building” – the tokens represent shares in the legal entity that owns the building.

Step 2: Creating the digital tokens. The property’s value gets divided into digital tokens on a blockchain platform like Ethereum. If a $1 million property gets split into 1,000 tokens, each token represents $1,000 worth of the property. These tokens contain smart contract code that automatically handles ownership rules, profit distribution, and transfer conditions.

Step 3: Compliance and investor verification. Before tokens go on sale, the platform ensures all securities regulations are met. Investors typically need to go through know-your-customer (KYC) verification, similar to opening a bank account. This isn’t the Wild West of crypto – tokenized real estate follows strict financial regulations.

Step 4: Trading and ownership management. Once sold, token holders can trade their shares on specialized platforms. The smart contracts automatically distribute rental income to token holders based on their ownership percentage. If the property appreciates in value, so does the value of each token.

Challenges and considerations in adopting blockchain in real estate

While blockchain offers many benefits, adopting it in real estate is not without hurdles. One major concern is regulatory uncertainty. Laws around property ownership, digital assets, and tokenized investments vary widely across countries, making compliance complex. Technology integration is another challenge. Existing property management systems and legal frameworks were not built for blockchain, so adapting them requires time, expertise, and investment. Security matters too. Even though blockchain itself is secure, digital wallets, token platforms, and smart contracts in real estate can still have vulnerabilities.

Understanding and trust are also key. Investors and property owners need to learn how smart contracts in real estate work, as automated, self-executing agreements can seem unfamiliar or risky. Additionally, tokenized real estate values can be affected by external factors like cryptocurrency market trends and investor speculation, creating volatility. Clear guidelines, education, and robust platforms are essential to ensure safe and effective adoption of blockchain in the property market.

Common questions investors ask

“What happens if the property management company goes bankrupt?”

Smart contracts can include provisions for automatic management transitions. Many platforms maintain backup management relationships to ensure continuous property operations.

“Can I actually visit a property I own tokens in?”

Token ownership typically doesn’t grant physical access rights, but some platforms organize investor events where token holders can tour their properties.

“How do taxes work on tokenized real estate?”

In most jurisdictions, tokenized real estate is taxed similarly to traditional real estate investments. Rental income distributions are typically taxed as ordinary income, while token sales may qualify for capital gains treatment.

“What if I want to sell but there are no buyers?”

This is the liquidity risk. While tokenization improves liquidity compared to whole property ownership, secondary markets for tokens are still developing. Some platforms offer liquidity pools or buyback programs to address this concern.

Content on BlockPort is provided for informational purposes only and does not constitute financial guidance.

We strive to ensure the accuracy and relevance of the information we share, but we do not guarantee that all content is complete, error-free, or up to date. BlockPort disclaims any liability for losses, mistakes, or actions taken based on the material found on this site.

Always conduct your own research before making financial decisions and consider consulting with a licensed advisor.

For further details, please review our Terms of Use, Privacy Policy, and Disclaimer.