Bitcoin’s impact on housing market: a Forbes analyst’s perspective

Abandoning the gold standard turned housing into an inflation hedge, argues Forbes analyst. Why Bitcoin might actually seize this role, returning real estate prices to their natural state.

For decades, affordable housing has slipped further out of reach for millions of Americans. Home prices have skyrocketed to the point where homeownership has transformed from a basic necessity into one of the most expensive investment assets. A market that once remained relatively stable now reflects not just supply and demand dynamics, but deeper shifts in monetary policy.

Enter Brian Domitrovic, a Forbes historian and journalist with a provocative theory. In his recent analysis, he traces today’s housing crisis back to when America ditched the gold standard in the early 1970s. Even more striking, he believes Bitcoin could become the instrument that reshapes how financial systems work and transforms the real estate landscape.

From gold standard to bubble: how the housing crisis began

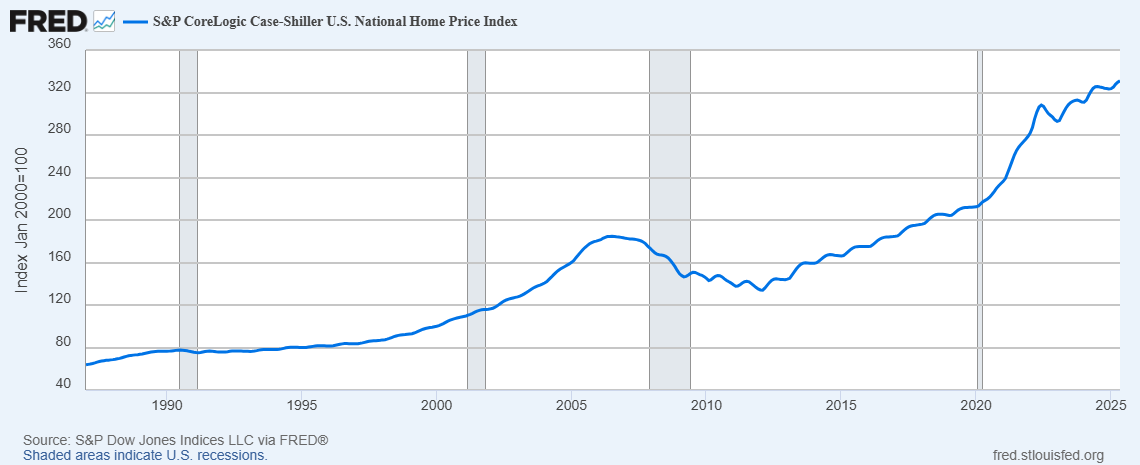

Domitrovic digs into Case-Shiller Index data, which has tracked housing costs for over a century. The numbers tell a clear story: U.S. home prices stayed remarkably stable through the mid-20th century, even declining during certain periods. Then everything changed in the late 1960s: home prices surged more than 50% in real terms during the 1970s.

The critical turning point, according to the analyst, occurred in 1971 when the United States abandoned the gold standard. Breaking that direct connection peg dollars and gold shattered confidence in the monetary system and pushed investors to seek new wealth preservation tools.

Land and housing, with their limited supply, became primary hedges against fiat currency debasement. This fundamental shift laid the groundwork for subsequent real estate bubbles.

Bitcoin as challenge to the traditional fiat system

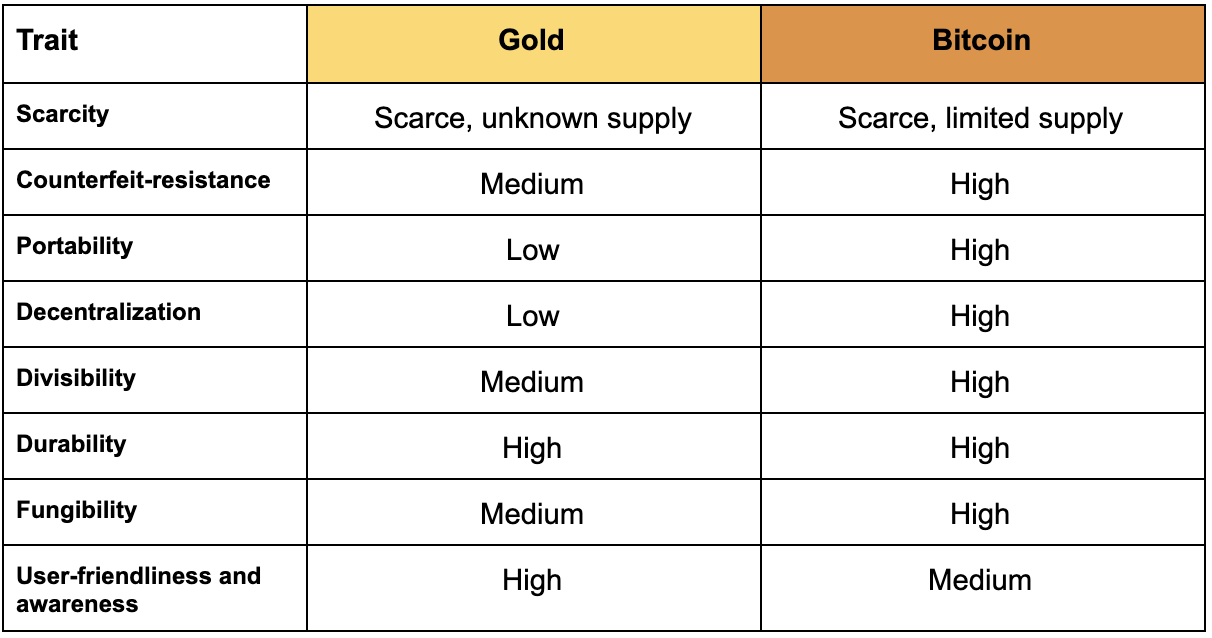

Domitrovic views Bitcoin not as another speculative asset, but as a symbol of distrust in the fiat system. He calls its emergence a market rebellion – society’s response to decades of inflation and monetary instability. It’s a way to opt out of the central bank game entirely.

In this logic, Bitcoin serves the same function that gold once did: a truly independent way to store wealth. If a significant portion of investors use digital money to protect against currency debasement, the need to seek “refuge” in real estate will diminish.

This means housing could gradually stop serving as an investment shield and return to its primary purpose – being an affordable place to live.

If Bitcoin becomes the “new gold”, housing markets will transform

Domitrovic predicts that as Bitcoin strengthens, the global financial system could move toward something more like the classical gold standard. In such a scenario, housing would stop being perceived as the primary defensive asset, and its cost would normalize. Homes would once again become living spaces rather than capital preservation instruments.

He notes that tax policy also influences prices. During the 1980s, limiting local tax growth accompanied increased housing affordability. But the decisive factor remains the monetary system. As long as the world operates under fiat currencies, real estate will maintain its role as a store of value. Bitcoin’s emergence could change this logic entirely.

Can Bitcoin Fix Housing?

Domitrovic’s ideas sound provocative, but that’s precisely their value. He challenges the established order and demonstrates that the housing crisis isn’t merely about supply and demand – it’s a consequence of global shifts in the monetary system.

In this framework, Bitcoin emerges not simply as a speculative asset but as a potential tool for rewriting financial rules. Whether it can actually transform the housing market remains an open question, but even having this conversation pushes crypto discussions beyond day trading and moon shots.

The analyst’s thesis forces us to reconsider fundamental assumptions about money, value storage, and housing accessibility. If Bitcoin can truly serve as a modern digital gold, we might witness the most significant real estate market transformation since the 1970s – except this time, regular families could actually benefit instead of getting priced out by speculators.

The implications extend far beyond crypto portfolios. We’re talking about whether an entire generation might actually be able to afford homes again. That’s a revolution worth considering.

Content on BlockPort is provided for informational purposes only and does not constitute financial guidance.

We strive to ensure the accuracy and relevance of the information we share, but we do not guarantee that all content is complete, error-free, or up to date. BlockPort disclaims any liability for losses, mistakes, or actions taken based on the material found on this site.

Always conduct your own research before making financial decisions and consider consulting with a licensed advisor.

For further details, please review our Terms of Use, Privacy Policy, and Disclaimer.