Search Data Reveals: The Altcoin Hype is Real

From institutional ETFs to DeFi, we dive into the core factors fueling a potential altcoin season and the next phase of crypto growth.

Why are so many users searching for “altcoin”? We’ll break down what’s behind the surge in interest in cryptocurrencies and what to expect from the market. An “Altcoin Season” is a period when the majority of altcoins (all cryptocurrencies except for Bitcoin) demonstrate a higher return than Bitcoin.

What’s Driving the Rise in Altcoin Interest?

Search activity often reflects market sentiment. In this case, the growing interest may be a result of several key factors that distinguish this cycle from previous ones.

First and foremost, there’s market maturity. The crypto industry has moved past its early chaotic phase and is now a much more developed and mature ecosystem, gaining acceptance from regulators. There’s a reliable infrastructure in place: institutional custodial services for storing assets, clearer legal frameworks in various jurisdictions, and sophisticated trading instruments available to large investors. Now, WEB3 users can evaluate projects that offer real products and have working ecosystems, rather than just speculating on ideas. This creates a foundation for long-term growth and reduces capital risks.

Furthermore, Bitcoin’s behavior has played a key role. After BTC reached its local highs, it entered a period of correction and consolidation, which prompted investors to look for new opportunities for high returns. Capital began to flow into riskier but more profitable digital assets, fueling discussions about a potential “flippening”.

Flippening is a hypothetical event in which the market capitalization of Ethereum (ETH) or another altcoin surpasses that of Bitcoin (BTC). While Bitcoin remains the leading cryptocurrency by market cap, the crypto community is actively debating the possibility of Ethereum eventually taking its place.

The main reason is that Ethereum is not just “digital gold,” like Bitcoin, but an entire ecosystem on which most decentralized applications (dApps), smart contracts, and NFT projects operate. This broad range of applications makes Ethereum more attractive to developers and investors seeking utilitarian assets. Ethereum’s growth is often accompanied by increased activity on its network and an influx of capital, which could, in the long term, become a powerful catalyst for such an event.

The behavior of retail investors is also a crucial factor. For them, altcoins are often more accessible because the entry price is much lower. This accessibility, combined with high volatility, offers the hope of faster and more significant profits with minimal investment. This phenomenon is amplified by social media, where mass hype and the fear of missing out (FOMO) spread quickly, encouraging more people to join the altcoin market.

Another important factor is technological progress. Here are some of the most significant areas that have attracted attention:

- Decentralized Finance (DeFi). Projects offering lending, staking, farming, and decentralized exchanges (DEX) without intermediaries continue to evolve, attracting capital into their ecosystems.

- Blockchain Gaming (GameFi). The “play-to-earn” model has proven its viability. Many new games and platforms have emerged, attracting both gamers and investors.

- Non-Fungible Tokens (NFT). Although the hype around NFTs has subsided a bit, they continue to develop. New projects offer the tokenization of real-world assets and useful use cases, not just digital art.

Does This Mean the Start of an Altcoin Season?

The surge in search queries is one of the early signals that often precedes an “Altcoin Season.” This period is characterized by most altcoins showing growth that significantly outpaces Bitcoin’s.

Some analysts believe we are already on the verge of it. The following indicators support this view:

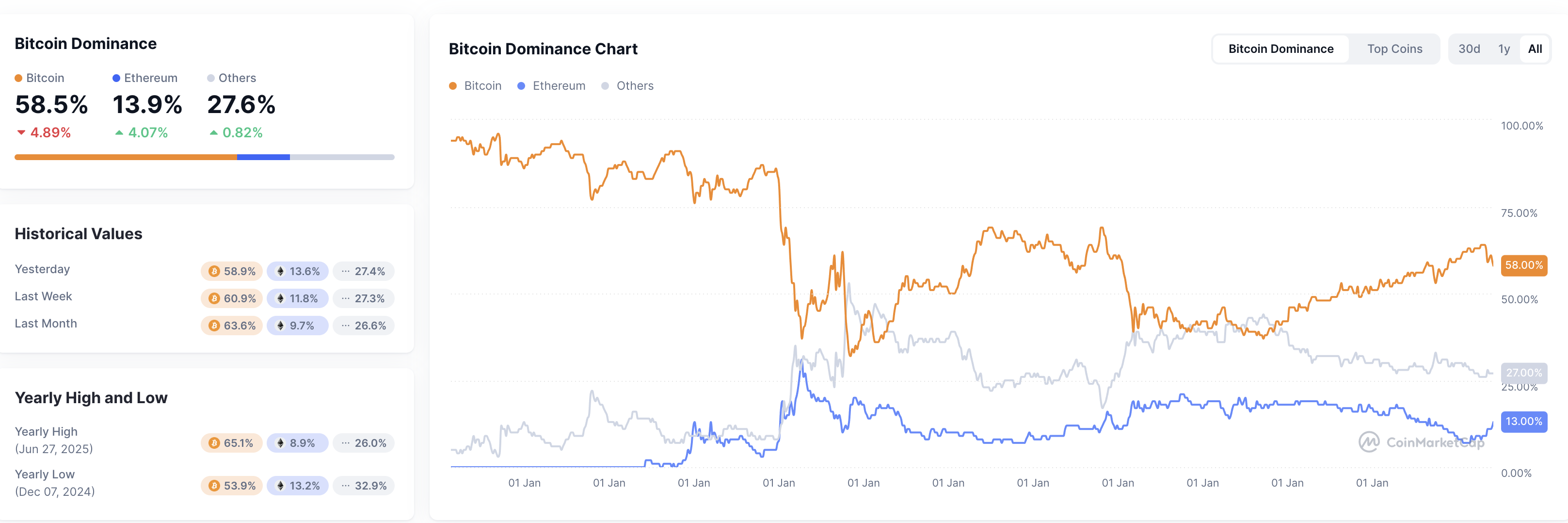

- Bitcoin Dominance. A decline in BTC’s market share from its previous local highs is a classic sign of capital being reallocated toward altcoins. According to CoinMarketCap data as of January 15, 2025, Bitcoin’s dominance has declined from 65.1% in late June 2024 to approximately 58.9%.

- Capital Inflow. According to analytics platforms, the total market capitalization of altcoins (excluding Bitcoin) has increased significantly in recent months, which indicates active buying.

- Institutional Investors. Although they still prefer Bitcoin, their interest in major altcoins is also growing. This is confirmed by the active filing of applications for Ethereum ETFs by companies like BlackRock, Grayscale, and Fidelity, as well as a shift in corporate treasury policies, which are starting to include Ether and Solana in their portfolios. This could serve as a powerful catalyst for increased interest in alternative assets as a financial instrument.

How Does the ‘Altcoin Season’ Index Work?

For a more accurate analysis of market sentiment, many traders use a special tool – the “Altcoin Season Index” index, provided by various analytics platforms like CoinMarketCap. Its purpose is to answer a simple question: Are we currently in “Altcoin Season” or “Bitcoin Season”?

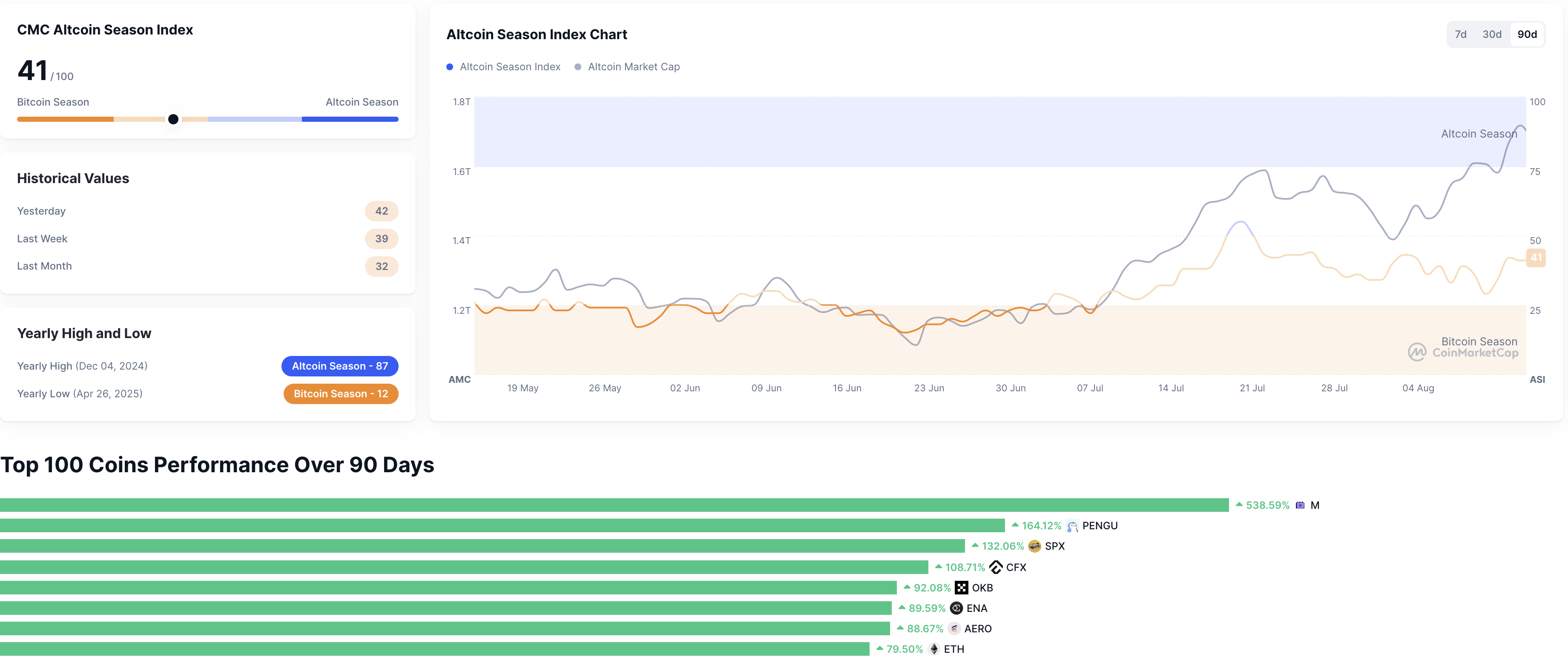

This index is calculated by comparing the performance of the top 100 altcoins (excluding stablecoins and asset-backed tokens) with Bitcoin’s performance over the last 90 days. If 75% or more of these altcoins have shown better returns than Bitcoin, it is considered “Altcoin Season.” When this figure is 25% or less, it is considered “Bitcoin Season.” Currently, the leaders in terms of returns are meme coins like PENGU, which have shown over 100% returns, as well as ENA (+89%), ETH (+79%), and BCH (+51%).

While the current Altcoin Season Index reads 41/100 – technically still in “Bitcoin Season” territory – this represents a significant 28% increase from the 32 recorded just one month ago, suggesting momentum is building toward a potential altcoin rally.

While past performance doesn’t guarantee future results, the convergence of declining Bitcoin dominance, increased institutional interest, and growing search volume creates compelling conditions for potential altcoin outperformance. Investors should monitor these metrics closely as early indicators of market rotation.

Content on BlockPort is provided for informational purposes only and does not constitute financial guidance.

We strive to ensure the accuracy and relevance of the information we share, but we do not guarantee that all content is complete, error-free, or up to date. BlockPort disclaims any liability for losses, mistakes, or actions taken based on the material found on this site.

Always conduct your own research before making financial decisions and consider consulting with a licensed advisor.

For further details, please review our Terms of Use, Privacy Policy, and Disclaimer.