Institutions Boost Ethereum Reserves to Record 8% of Supply

Ethereum is gaining ground among institutional players, as combined ETF holdings and treasury reserves reach historic peaks.

Institutional investors currently hold 7.98% of Ethereum’s circulating supply – a historic high. These positions are primarily concentrated in exchange-traded funds and the treasury portfolios of publicly listed companies, highlighting a marked increase in institutional confidence toward ETH.

In spring, this percentage was half as large. But within months, institutional capital has flooded in, expanding its footprint and helping push ETH toward new local highs.

From Zero to Hero: How Spring Changed Everything for Institutional ETH

As of early April, Ethereum ETFs and corporate reserves accounted for about 3% of its total supply. That figure has since jumped to nearly 8%. Just months ago, no public company listed ETH as a reserve asset – a fact that underscores how dramatically things have changed.

Among leading corporate holders, Bitmine Immersion Tech holds 1.2 million ETH, The Ether Machine owns 598,800 ETH, and SharpLink Gaming follows with 345,400 ETH. ETF portfolios have also expanded rapidly, growing from 3.5 million ETH to 6.15 million – over 5% of circulating supply.

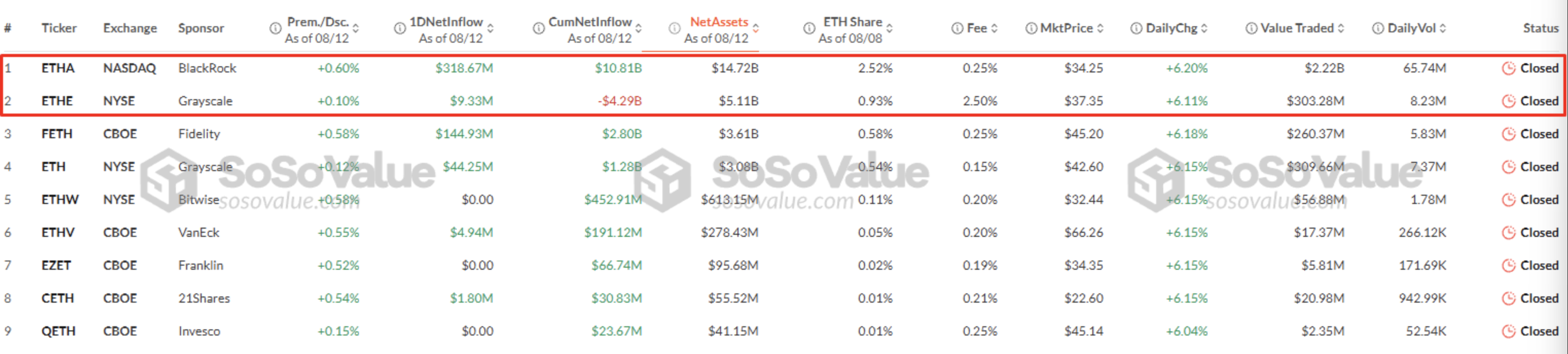

BlackRock vs. Grayscale: The $32 Billion ETF Battle for Ethereum Dominance

BlackRock and Grayscale lead the pack in Ethereum ETF offerings. The iShares Ethereum Trust ETF, BlackRock’s flagship ETH product, manages around $14.7 billion in assets, while Grayscale’s Ethereum Fund accounts for roughly $3 billion.

Altogether, Ethereum ETFs now hold $31.9 billion – about 17.8% of the value locked in Bitcoin-focused funds. Since the end of June, ETH fund AUM has surged from $14.6 billion, more than doubling in just a few months and highlighting an unprecedented growth trajectory.

Why Smart Money Is Betting Big on Ethereum

The growing allocation to Ethereum by major funds and listed companies reflects its unique positioning. Beyond serving as a store of value, ETH provides exposure to the world’s largest smart contract platform – a critical gateway to decentralized apps and Web3 innovation. This dual utility makes it attractive for institutions seeking both growth and diversification.

Analysts attribute part of this trend to Ethereum’s lag behind Bitcoin in recent performance, creating a more compelling entry point. If macro tailwinds hold, ETH may deliver stronger short-term returns. However, elevated volatility and systemic crypto risks remain, posing potential for sudden drawdowns alongside upside.

Wall Street Meets DeFi: How Institutional Adoption Reshapes Ethereum’s Future

The surge of institutional capital into Ethereum speaks volumes. It’s not just about money – it’s about validation. The crypto space is shifting from experimental to established, and the growing role of major financial players signals a new phase of credibility and stability.

This could pave the way for more consistent price performance and breathe new life into areas like DeFi, tokenized assets, and enterprise chains. But there’s a tradeoff. As Ethereum leans into Wall Street, it also becomes more vulnerable to the tremors of traditional finance. What builds strength can also bind.

Content on BlockPort is provided for informational purposes only and does not constitute financial guidance.

We strive to ensure the accuracy and relevance of the information we share, but we do not guarantee that all content is complete, error-free, or up to date. BlockPort disclaims any liability for losses, mistakes, or actions taken based on the material found on this site.

Always conduct your own research before making financial decisions and consider consulting with a licensed advisor.

For further details, please review our Terms of Use, Privacy Policy, and Disclaimer.